“With the changing economy, no one has lifetime employment.”- Barack Obama

"Demonetisation" is now a household topic in India and has impacted the Indian economy along with lives of citizens. The shocking announcement on November 18th, 2016 by the Prime Minister made redundant, 87% of the currency with old Rs. 500 and Rs. 1000 notes in circulation ceased to be 'Legal tender'. This created a Tsunami of sorts for the economy & common man. 0.4% loss in India’s industrial production was recorded for December 2016 alone, due to demonetization and Inflation of Food items reportedly changed to 47.3% of the total CPI. As per Bloomberg, the volume of Cash transactions in India is a whooping 98% as compared to UK (46%) and USA (55%).

Effects of Demonetisation on the Jobs and Corporate Sector

The crunch of Hard has affected companies, employees and contractual workers. Organisation worked proactively with banks to help ease out some burden with mobile ATM’s. Policies and guidelines have been framed to encourage digital transactions and move towards a cashless & paperless economy as far as possible. Rapidly changing technology has affected businesses beyond expectations. Whether due to globalization or demand of the workforce, changing technology has led to increased transparency, remote working and better methods of monitoring employees.

The crunch of Hard has affected companies, employees and contractual workers. Organisation worked proactively with banks to help ease out some burden with mobile ATM’s. Policies and guidelines have been framed to encourage digital transactions and move towards a cashless & paperless economy as far as possible. Rapidly changing technology has affected businesses beyond expectations. Whether due to globalization or demand of the workforce, changing technology has led to increased transparency, remote working and better methods of monitoring employees.The corporate sector are increasingly promoting digitisation by transitioning to new modes of payment for most transactions: from Recruitment to Retirements and even reimbursements. 'Digitization' leads to elevated efficiency, reliability, pace and quality that makes the system more transparent. It eradicates malpractices and corruption in the organization by making the system more transparent. Going digital also means reducing the carbon footprint of your firm with less paperwork and less wastage of resources.

The impact of liquidity crunch since demonetisation has been so drastic that it is estimated to take at least a year for firms to recover. Loss of circulation & consumer buying has led to lay offs, thereby increasing unemployment.

Here's a look at some of the key impacted sectors: -

Ecommerce & Logistics

About 50-80% of ecommerce transactions were on 'Cash of Delivery' (COD) bases, as per estimates which drastically declined. More prevalent with Tier-2 & Tier-3 city consumers. Business volumes of the allied Logistics companies also dried up and most innovating to accept 'Card on Delivery' payments.

The impact was so massive that Investors have questioned the overall business model of large ecommerce firms and now mandating a focus on Unit economics and sticking to verticles having core expertise. Over 1000 employees laid off by leading ecommerce companies like Snapdeal, Yepme, Flipkart and more.

The impact was so massive that Investors have questioned the overall business model of large ecommerce firms and now mandating a focus on Unit economics and sticking to verticles having core expertise. Over 1000 employees laid off by leading ecommerce companies like Snapdeal, Yepme, Flipkart and more. "About 40% of COD was driven through Black money" - Amrish Rau, CEO, PayU India

Digital Payments

Digital Payments sector went on a roll with 271% growth in the very first month, as the next alternative medium of cash transactions. Leading provider PayTM served 45 million users in just 3 months, beating all business estimates.

Manufacturing Sector

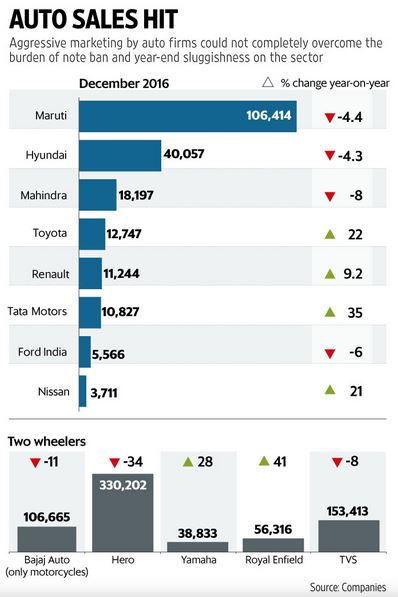

‘’The auto industry has lost Rs. 8,000 crores due to demonetisation’’. As per reports, the sector lost 55% of revenue and 35% jobs in the very first month reflecting upon the bloothbath in the SME manufacturing domain.

Automobile sector

Automobile sectorThe automobile sector has reported a downfall in their sales of machinery and large equipment. If this persists, they will have to lay off people; resulting in mass unemployment. Many of the employees who work in the manufacturing industries are often the low skilled category of workers. In December 2016, the Two wheeler industry shrinked by 25%. Sales for leading car manufacturers like Maruti Suzuki & Hyundai motors fell by 4%.

Infrastructure and Engineering sector

This sector mainly comprises a great workforce of unskilled and semi-skilled workers. Since demonetisation has occurred, there has been a great reduction in their sales; which will also result in mass lay-offs. But, that the intensity lasted for about a month and the sector is largely unaffected, especially the EPC (engineering, procurement, and construction) sector; road developers.

Engineering sector witnessed a setback. As per HDFC Securities analysis, “Revenue declined 20 per cent year-on-year to Rs 970 crore (Rs 9.7 billion), led by a muted order book and impact of demonetisation... The December quarter also saw the impact of demonetisation, in the absence of which revenues would have been higher by 4-5 per cent.”

Consumer Goods

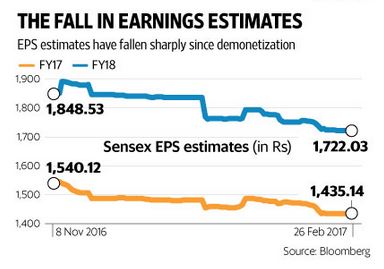

Consumer GoodsDemonetisation had a major impact on sales in the consumer goods sector. Consumer electronics was the worst hit in Domestic appliances segment. The stock market trend of falling EPS, shows the onslaught in the Consumer Goods sector.

Future Hiring in India

Demonetisation may be soon over, but its effects will continue to hit the Indian economy for the foreseeable future. While demonetisation was aimed to curb the growing corruption, fake currency and black money; it has also affected all of the common population of India. Long lines at the ATM were just a fraction of what the public had to bear in the after-math of demonetisation. The immediate effect of demonetisation was chaos; for firms and for the population.

It is predicted that hiring will increase by 50% in the April-June quarter as the effects of demonetization fade away and India's GDP projected growth of 7.6% will get reduced to 7.1% in 2017. This is mainly accrued to demonetization and it's concurrent effect in manufacturing, mining and construction sectors. Apart from these, many more sectors especially the fast moving consumer goods (FMCG) and the automobile industry, will slow down their hiring and even increase their layoffs. IT sector is likely to see an increase in hiring due to the now digitalised version of payments and increased transactions online. Recruiters have predicted that at least 100,000 job cuts will occur mainly in the Real estate, Construction and Infrastructure sectors. The Central Government however, aims to hire 2.8 lakh more staff, primarily in Police, Income Tax & Customs. What remains to be seen is how the private organised sector is going to manage the liquidity crunch and how the loss of jobs will affect India’s population at large.

Posted in : News & Trends

Views : 42903

Leave a Comment

Hey there !

Author Details

Related Blogs

Popular Tags

Subscribe Now

Related Blogs

More fromNews & Trends